Returns

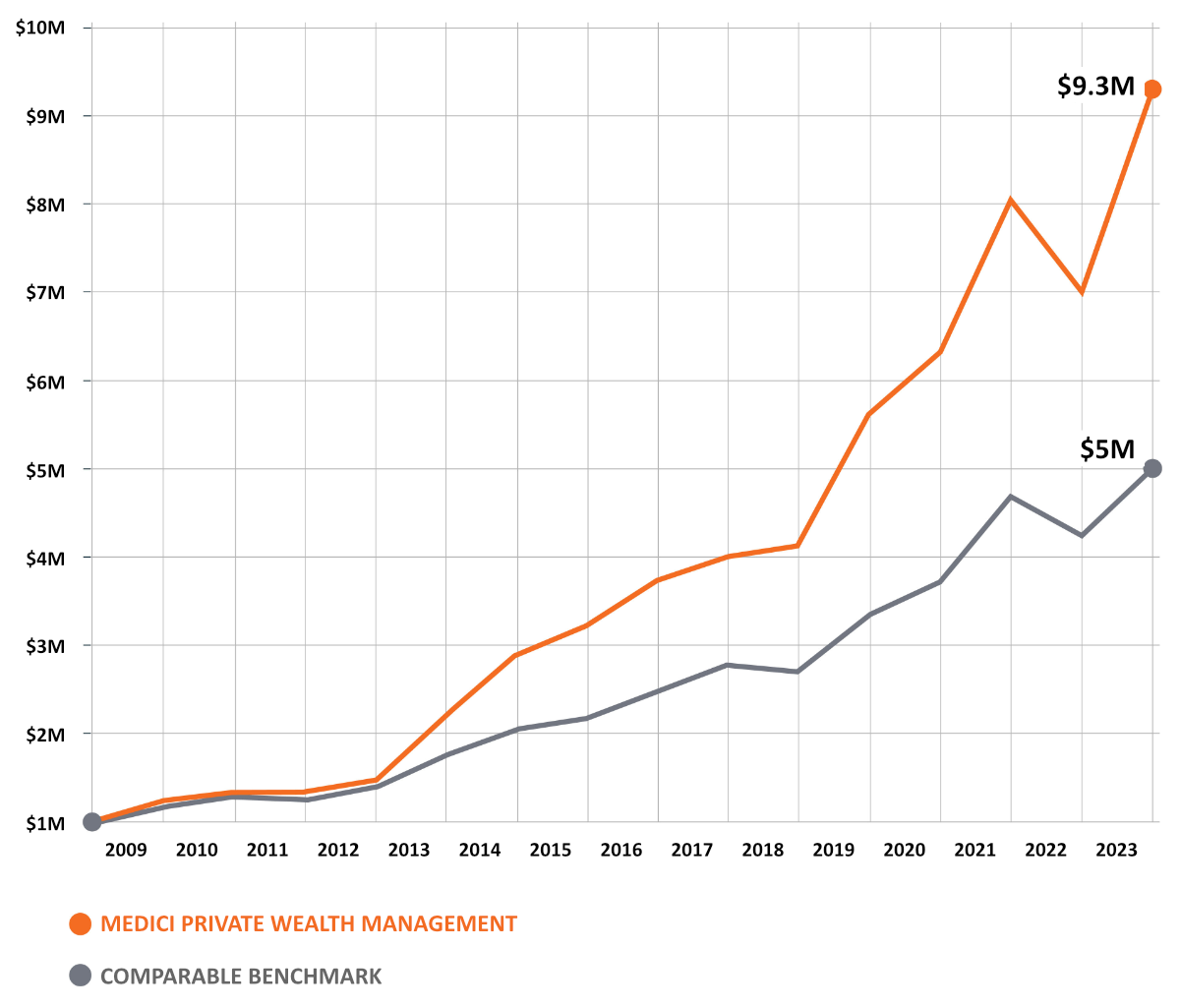

$1M invested 15 years ago would now be worth…

$1M invested with Medici 15 years ago would be worth $9.3M today. *

The same amount in a fund with a comparable benchmark would be worth $5M.

* As of December 31, 2023

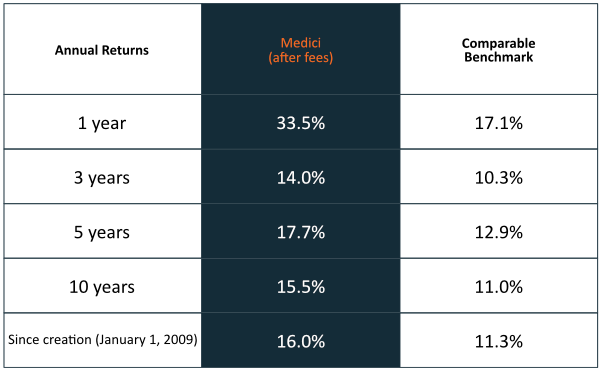

Annual Compound Return

(After fees)

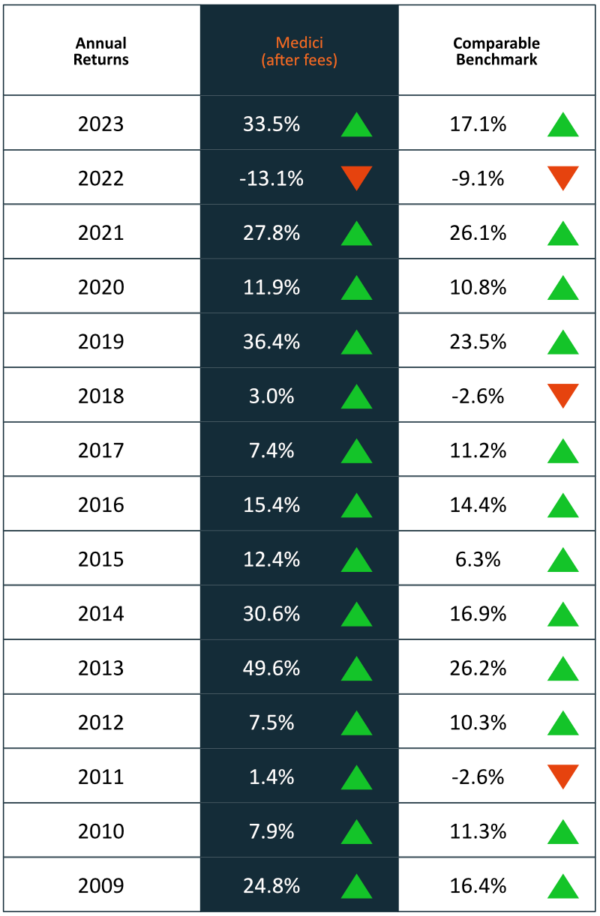

Historical performance of Medici

(After fees)

How does Medici invest your money?

How to invest with us?

From 2009 to 2010, published returns represent the average return obtained by all clients of Gestion Privée Medici following an asset allocation of 35% fixed income and 65% equity. From 2011, published returns represent the average return obtained by all clients of Gestion Privée Medici following an asset allocation of 100% equity. As of 2022, the average returns also include those obtained by Medici’s Fund clients following an asset allocation of 100 % equities. Average annual fees of 1,2% including sales tax are included in the calculation of returns. Published returns are expressed in Canadian dollars. Past performance is no guarantee of future results. The past returns of Medici were obtained with a diversified portfolio of 10 to 25 companies selected in accordance with the investment strategy presented on our website. The comparable benchmark is built using the three following exchange-traded funds: iShares Core Canadian Universe Bond Index ETF (XBB), iShares Core S&P500 Index ETF (XUS) and iShares Core S&P/TSX Capped Composite Index ETF (XIC). Since 2011, the iShares Core Canadian Universe Bond Index ETF (XBB) is no longer part of the formula for calculating the comparable benchmark. The comparable benchmark includes the management fees deducted by iShares from the exchange-traded funds as well as the dividends. Medici collects the data provided by BlackRock on its website and considers the data to be reliable at the time it is collected.