Invest with Medici

3 Simple Steps to become a client

Give us a call

One of our portfolio managers will discuss with you to assess your needs and determine if you meet the requirements to become a client.

This initial phone conversation will also give you the chance to ask questions and determine whether Medici can help you reach your financial goals.

Meet our portfolio managers

The in-person meeting gives you a better understanding of our investment strategy, while allowing us to get a better picture of your financial situation.

We will write up a mandate specific to your situation and establish a financial plan that will help you reach your goals.

Medici takes care of everything else

No need to worry! At this stage, Medici takes care of preparing all the necessary documents to open your new investment accounts with our trustee, the National Bank Independent Network. We take care of the follow-up, we verify transfers, and we purchase and sell the securities according to the agreed-upon mandate.

From the start, you receive an online login that allows you to monitor the evolution of your portfolio.

Ready to become a client of Medici?

The principles behind Medici

What you need to know about Medici

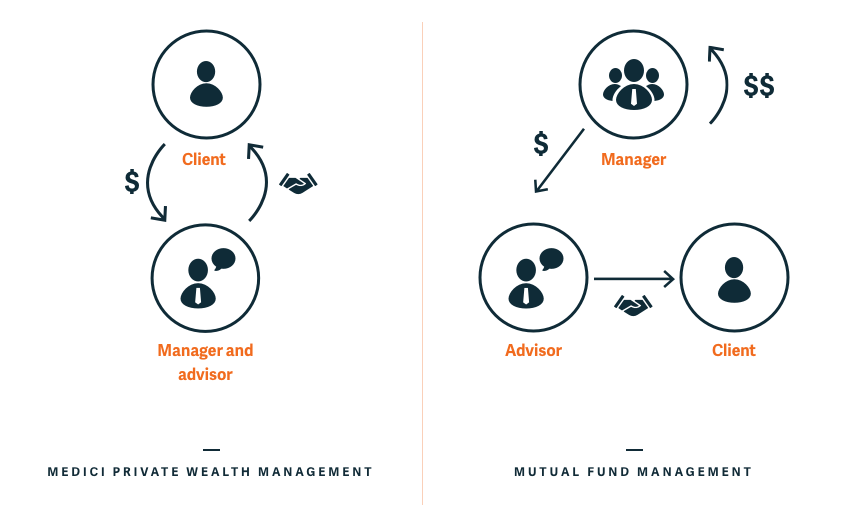

No hidden fees and no expensive middlemen here. We are both your financial advisor and your portfolio manager. Our return statements are clear, after fees, compared to the appropriate benchmark, and accessible at any time. We communicate with you regularly and honestly, and we’re not afraid to own up to our mistakes. You can easily reach our team to get answers to your questions.

We are passionate about businesses, not about stock price movements. It can take over a hundred hours of research and analysis to determine the right price that we are ready to pay in order to acquire an exemplary company’s stock. Once we have targeted the right company, we continue our research in order to increase our understanding of their business. This work means we invest with confidence and avoid diluting a portfolio’s potential for growth with too many positions. Our portfolio managers own the same securities as the ones they buy for our clients. If a company isn’t good enough for us, it isn’t good for you either.

We put the interests of our clients before those of our firm or its portfolio managers. The reason for the practices we put in place is to ensure client satisfaction, not the profitability of our firm. For example, we meet our clients individually once a year in order to help them set realistic financial goals. Once these goals are decided on, we accompany them to help them achieve the goals in question.

We do not work in “silos”. Our portfolio managers are part of a multidisciplinary team, in which members combine their skills and assets to offer you the best service possible. Instead of benefiting from one portfolio manager, our clients have access to an entire team, no matter what their needs are.

Medici was founded on the same principles we would’ve liked to find as clients, that is: a portfolio management service that is accountable, personalized, and transparent.

Carl Simard and Dany Foster

Adherence factors

In order to ensure high standards, Medici asks that its clients adhere to the five selection criterias below. Clients who understand these requirements can become true partners in the management of their portfolios.

Knowledge is the best antidote to worry. Those who take the time to understand our strategy have the knowledge they need to tolerate the inevitable market crises more easily. We invite our clients to spend some time reading our quarterly letters throughout the year in order to deepen their understanding of our investment strategy.

In order to serve you better, we need to understand your ability to tolerate risk. As a result, we will take all the time we need to get to know you. You also need to inform us whenever your situation changes and you need to be perfectly honest with us with regards to your capacity to endure periods of volatility.

From time to time, we will underperform. Since we started in the business, we performed below the market one year out of three, even though we beat the market over the longer term. . Even the best investors underperform from time to time. Because we can’t control short-term variations in the market, we focus our efforts on obtaining returns that outperform the market in the long term. However, that means you need to be patient during periods of underperformance.

Crises will happen, but since it’s impossible to predict when, we don’t waste any time trying. What we do is invest in outstanding companies when they’re available at reasonable prices. As a result, we invest your assets based on the opportunities currently in the market. If we don’t find any opportunities, the portfolios will contain more liquid assets. We encourage our clients to embrace a similar attitude with regards to the unpredictable nature of crises.

In the statements we send you, we include a benchmark that you can use for comparison. This reference scale includes the performance indicators for the Canadian and US stock markets, as well as Canadian bonds (if applicable). The statement also takes into account the foreign exchange rate, dividend and interest income, as well as management fees. However, as we invest with a long-term investment perspective, we wish to be compared to this reference scale over a period of five years, and not over a few months.